Stock portfolio risk calculator

Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients. Finally we can calculate the VaR at our confidence interval var_1d1.

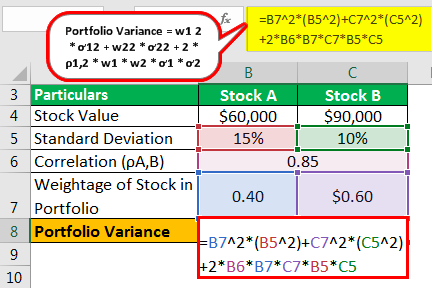

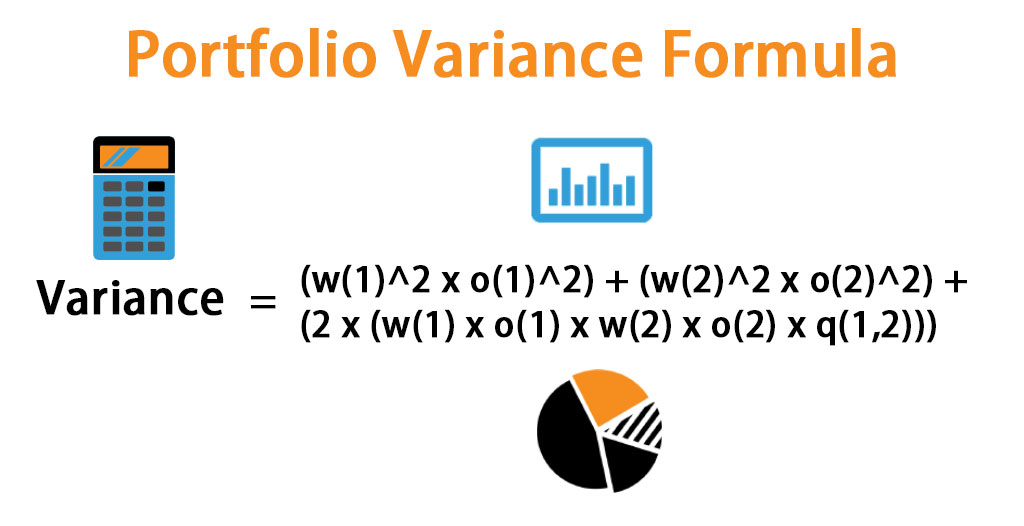

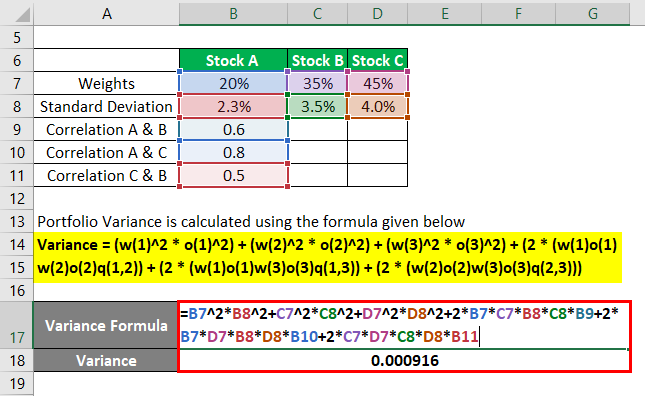

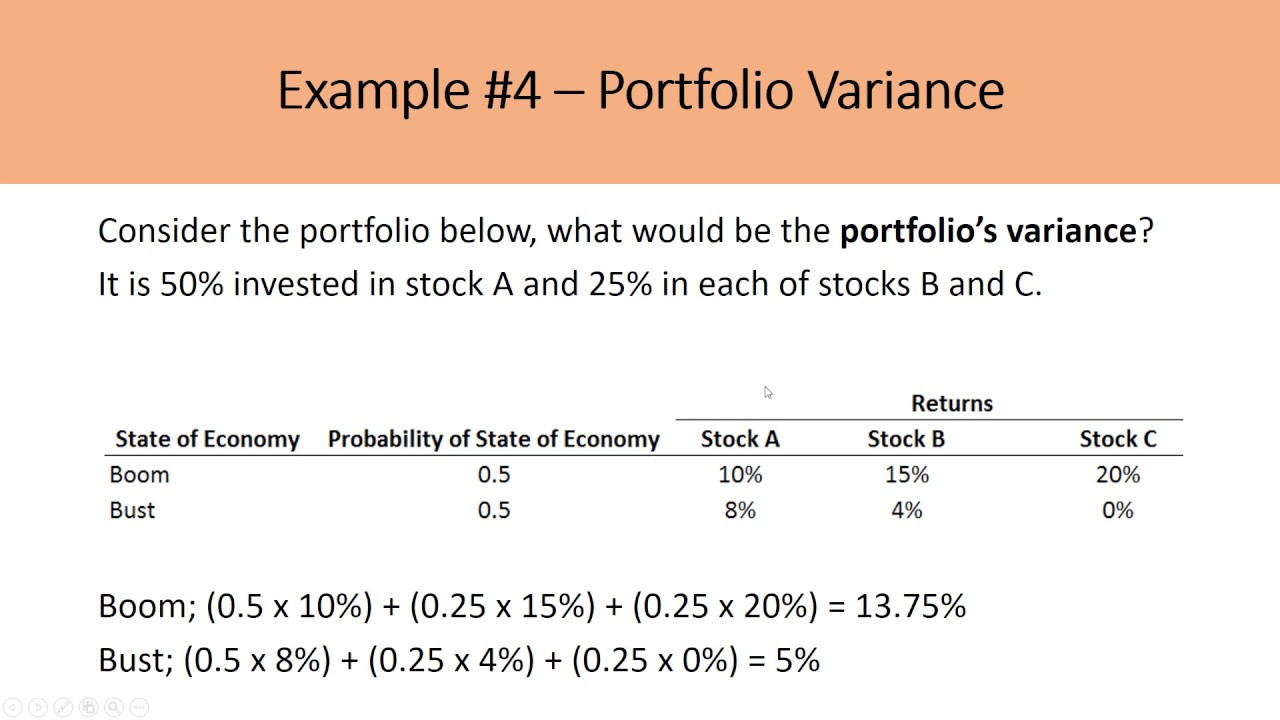

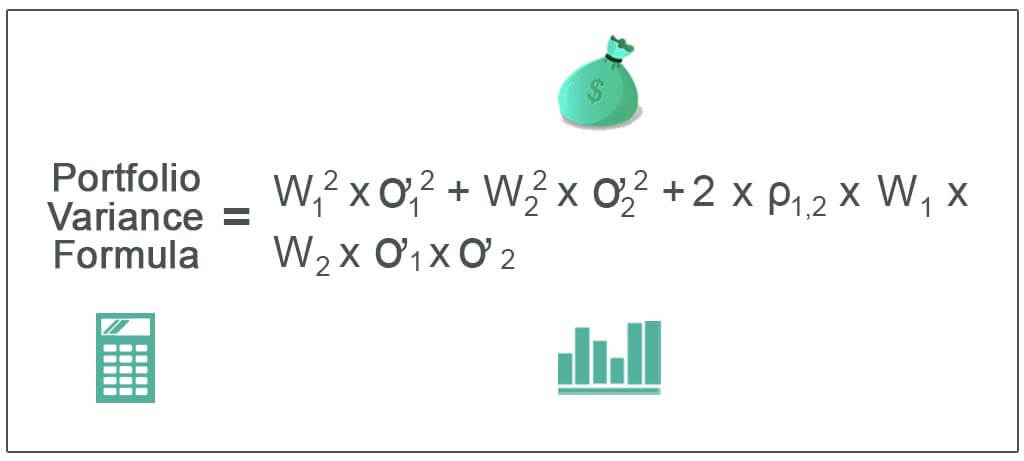

Portfolio Variance Formula Example How To Calculate Portfolio Variance

This implies that the portfolio risk is 06 or 60.

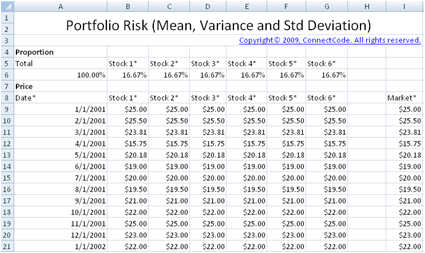

. Variance and standard deviation. It shows the total risk of the portfolio and is important data in the. Try Tableau for Free.

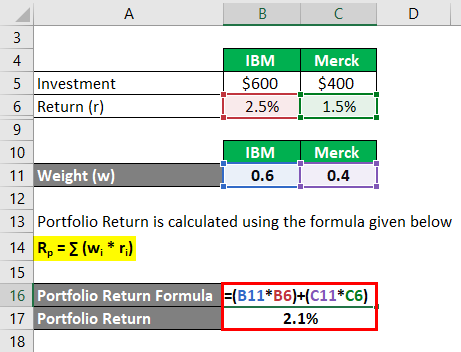

RP w1R1 w2R2. The calculator determines the IDIVs Dividend Cash Flow Exposure 1 relative to a similar sized investment in the underlying equity. If you buy a stock at 50 your stop.

Specify StockETFCryptos quantities to instantly view Value at Risk VaR for portfolio using recent financial data. Ad Make Investing Easier With A Portfolio Managed With Robo-Advice Technology. Its an easy portfolio management tool for reducing risk.

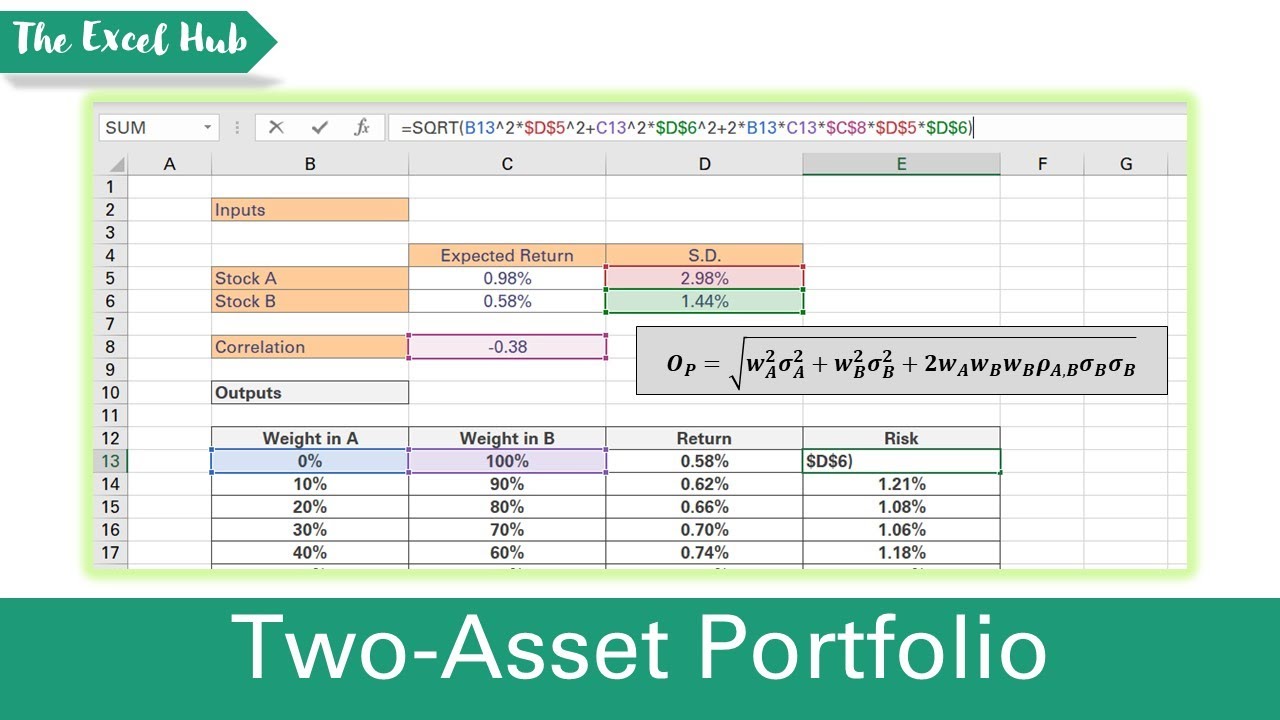

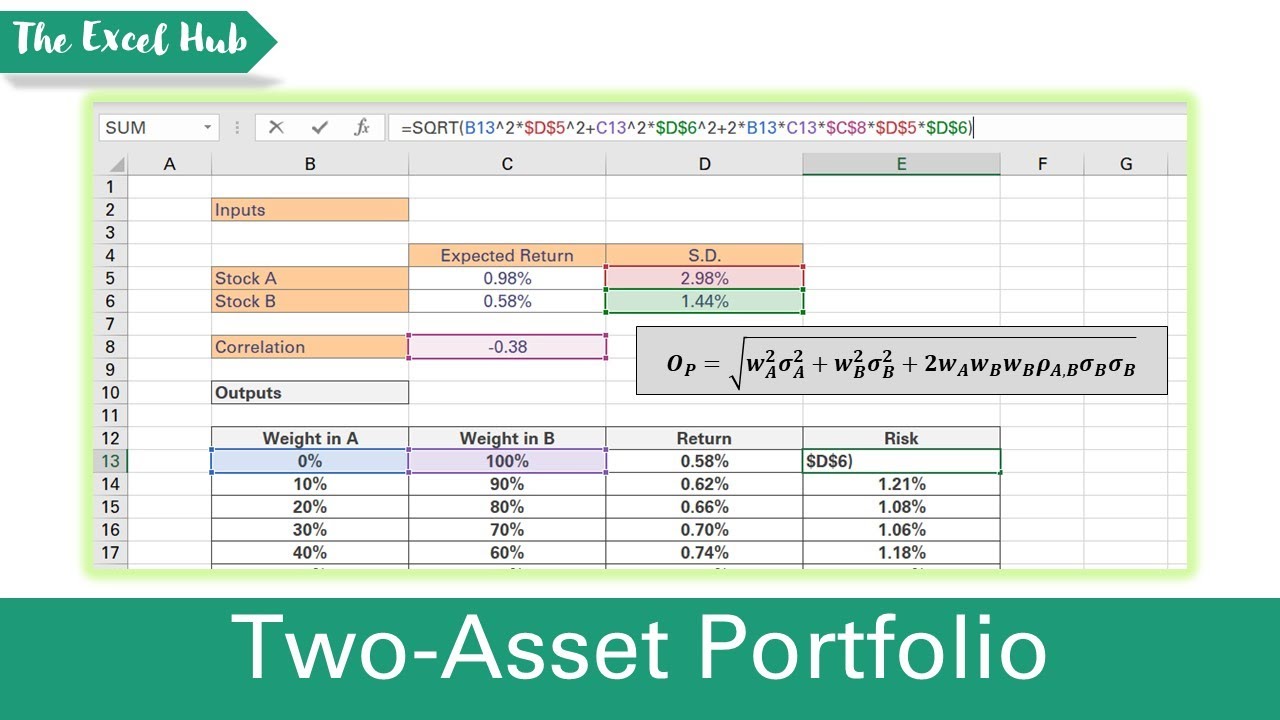

This calculator is designed to calculate the expected return and the standard deviation of a two asset portfolio based on the correlation between the. Portfolio standard deviation is the general standard deviation of a portfolio of investments of more than one asset. Investors Business Daily often suggests a 7 or 8 automatic sell from your purchase price.

This may seem low to you if youve read that the stock market averages much higher returns over the course of decades. 5 Estimate the value at risk VaR for the portfolio by subtracting the initial investment from the calculation in step 4. They are designed to optimise the risk return relationship including currency considerations.

The calculator below provides key investment portfolio risk metrics. Risk or variance on a single stock. Absolute risk - Calculate two measures of absolute risk for each individual stock.

Ad Objective-Based Portfolio Construction is Key in Uncertain Times. Well the SmartAsset investment calculator default is 4. Lets take a simple example.

Risk contributions volatility beta value at risk VaR maximum drawdown correlation matrix and intra-portfolio correlation. Today most investors are wondering what they should do with their money in the wake of interest rates being cut inflation increasing the stock market crash and. Try Tableau for Free.

Ad Answer Questions as Fast as You Can Think of Them. If you dont want to take any risk with your money you should probably look to put your money in cash however you need to be aware that there is limited chance of. Automated Investing With Unlimited Advice From A Certified Financial Planner.

Risk contributions volatility beta value at risk VaR and maximum drawdown estimates help you understand your existing. This calculator is a guide to help you design investment portfolios for five different levels of risk. Ad The Definitive Guide to Retirement Income from Fisher Investments.

Mean Variance Optimization Find the optimal risk adjusted portfolio that lies on the efficient. Im looking for safety first. The returns from the portfolio will simply be the weighted average of the returns from the two assets as shown below.

Ad Answer Questions as Fast as You Can Think of Them. Importance of calculating Portfolio. Compare the past risk and return of your current investments to the IFA Individualized Index Portfolio recommended at the end of your Risk Capacity Survey the SP.

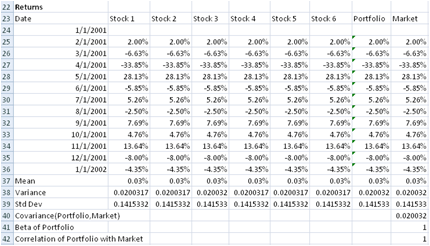

The following table gives the computation of the. This normally lies in the medium high risk and it means the risk profile is described to be relatively high. Learn 7 ways to generate income in retirement with investing strategies from this guide.

Value At Risk is a standard. Learn How We Can Help. This portfolio optimizer tool supports the following portfolio optimization strategies.

Select only the assets you want to include in your portfolio. The variance of the return on stock ABC can be calculated using the below equation. The IFA Index Calculator.

Relative risk - Evaluate two measures of risk for each pair of. Online Value At Risk Calculator for Portfolio. InvestSpy provides you with free access to.

Risk Return for a Two Asset Portfolio.

Free Modern Portfolio Risk Mean Variance Standard Deviation Covariance Beta And Correlation

Portfolio Analysis Calculating Risk And Returns Strategies And More

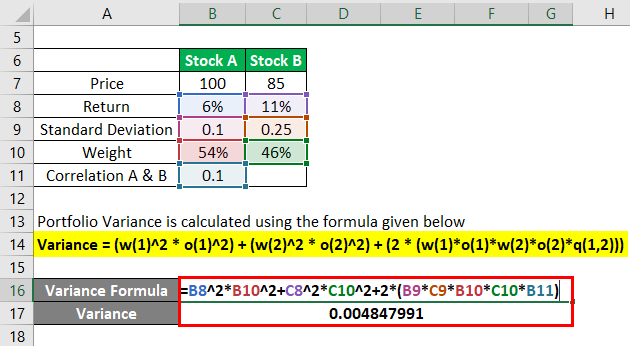

Portfolio Variance Formula How To Calculate Portfolio Variance

How To Easily Calculate Portfolio Variance For Multiple Securities In Excel Youtube

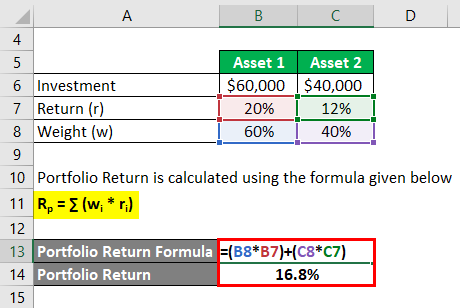

Portfolio Return Formula Calculator Examples With Excel Template

Risk Part 4 Correlation Matrix Portfolio Variance Varsity By Zerodha

Portfolio Return Formula Calculator Examples With Excel Template

Portfolio Variance Formula How To Calculate Portfolio Variance

Position Size Calculator Investment U Investment Tools

Free Modern Portfolio Risk Mean Variance Standard Deviation Covariance Beta And Correlation

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

How To Calculate Var Finding Value At Risk In Excel

Portfolio Return Formula Calculator Examples With Excel Template

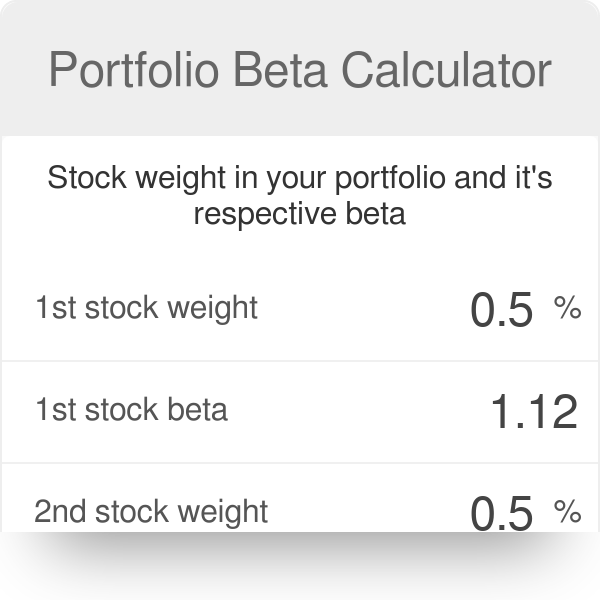

Portfolio Beta Calculator

Portfolio Variance Formula How To Calculate Portfolio Variance

Calculate Risk And Return Of A Two Asset Portfolio In Excel Expected Return And Standard Deviation Youtube

Portfolio Variance Formula Example How To Calculate Portfolio Variance